2025 Bitcoin Mining Machines Review: What to Know Before You Buy

As we dive into the intricacies of Bitcoin mining in 2025, it is essential to comprehend the balance between technology and strategy. The evolution of mining machines is rapid, shaped by an insatiable demand for efficiency and power. Whether you’re a seasoned miner or a novice looking to plunge into the world of cryptocurrencies, making the right choice can significantly influence your profitability.

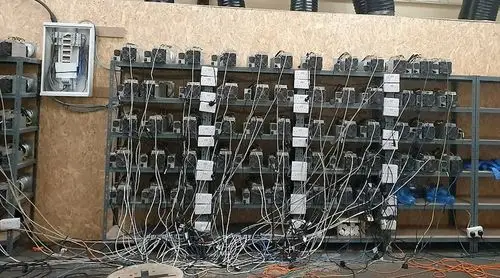

At the crux of Bitcoin mining are the machines themselves—dedicated hardware designed to perform the complex calculations required to validate transactions on the blockchain. These machines serve as the backbone of this digital currency ecosystem, each brand and model claiming to offer something unique. In 2025, the market is teeming with innovative miners, each with enhanced performance metrics that cater to diverse mining strategies.

Recent advancements have given rise to ASIC (Application-Specific Integrated Circuit) miners, which outshine traditional GPU rigs with their superior hashing power and energy efficiency. Miners today need to consider factors like power consumption, hash rate, cooling capabilities, and, notably, the initial investment cost. The top models on the market promise an enticing return on investment, but it’s prudent to conduct thorough research before making a leap into purchase.

In the realm of cryptocurrency, hosting your mining machine can be equally significant. Many new entrants opt to use hosting services, sparing themselves the intricacies of setting up a mining farm. A reliable hosting partner can provide the necessary infrastructure, allowing you to tap into the benefits of top-tier hardware without the hassle of managing it yourself. This option often guarantees optimal cooling, steady power supply, and professional maintenance, all crucial for maximizing your mining output, especially when competing against thousands of other miners globally.

When discussing cryptocurrencies like Bitcoin (BTC), Dogecoin (DOG), and Ethereum (ETH), it’s important to recognize how varying algorithms necessitate different mining approaches. For instance, while BTC relies on the SHA-256 algorithm, ETH miners will adapt to the Ethash system. This difference in architecture means that the choice of mining rig can vary drastically depending on which cryptocurrencies you’re targeting, urging miners to keep a flexible strategy on where they allocate resources.

Furthermore, the recent shifts in market dynamics hint at a potential resurgence of Dogecoin. Initially dismissed as a meme coin, DOGE has garnered attention due to its dedicated community and newfound utility within various payment systems. Miners capitalizing on this opportunity may find their strategies shifting from traditional Bitcoin mining to more diversified approaches that include altcoins like Dogecoin. Timing and adaptability will be crucial in this ever-evolving landscape.

The efficiency of mining operations can greatly hinge on the selected hardware configurations. With the exponential rise of transaction volumes across platforms, it’s become a race against time to procure the latest hash-heavy miners equipped for the current difficulty levels present in Bitcoin mining. One must keep an eye out for models promising futuristic enhancements like integrated AI to monitor operational efficiencies and minimize downtime.

Moreover, opting for mining pools can also offer miners another layer of strategy. When participating in a mining pool, individual miners contribute their resources toward a collective goal, sharing rewards based on the computational power each miner contributes. This can be particularly advantageous when competing against major mining farms with essentially limitless resources. In 2025, many options exist for miners to find a pool that aligns with their goals, be it Bitcoin-centric or a more expansive focus including various altcoins.

Investing in a sophisticated mining rig is just the tip of the iceberg. The environmental aspect cannot be ignored either; sustainable energy solutions are rapidly emerging, affecting both new and existing miners. Utilizing solar power or wind energy is becoming increasingly popular, positioning miners as responsible participants in this technological space. Choosing greener mining options may not only reduce operating costs but could also appeal to a demographic increasingly concerned about the ecological footprint of cryptocurrency mining.

As we glance toward the future, it’s clear that cryptocurrency mining remains a multifaceted business. Beyond mere hardware, the choice of mining machine encapsulates strategic foresight that incorporates market trends, community sentiments, technological advancements, and sustainability considerations. In 2025, being informed about what is on the market, and how these elements interplay can empower both new and experienced miners to make the most of their investments. The bricks laid today will forge routes into the lucrative future of cryptocurrency mining, one hash at a time.

This review dives into the latest 2025 Bitcoin mining machines, exploring efficiency, cost, and environmental impact. From revolutionary cooling tech to unexpected energy consumption trends, it offers a comprehensive guide for both beginners and seasoned miners navigating the evolving crypto landscape.